Table of Content

As a consequence of the findings, we can conclude that after making the first prepayments, both the Total Savings and the Updated Interest decline. To obtain the monthly interest rate in this calculation, we divided the annual interest rate by 12. Afterward, to calculate the interest amount, multiply it by the remaining principal amount.

You must take the following factors into consideration before you arrive at a decision. Of course, there are circumstances under which the prepayment on Housing loan penalty charge cannot be levied by lenders. Information about how to use our free home mortgage calculator and definitions of some of the terms are included as cell comments in the spreadsheet. So, if you have questions, you can hover the mouse cursor over any cell that has a little red triangle in the corner. Show them how they can save hefty amount by doing home loan prepayment. Hence, keeping around 10% additional amount along with your regular EMI is a better idea than tightening your monthly budget.

# Principal and Interest paid after a specified period

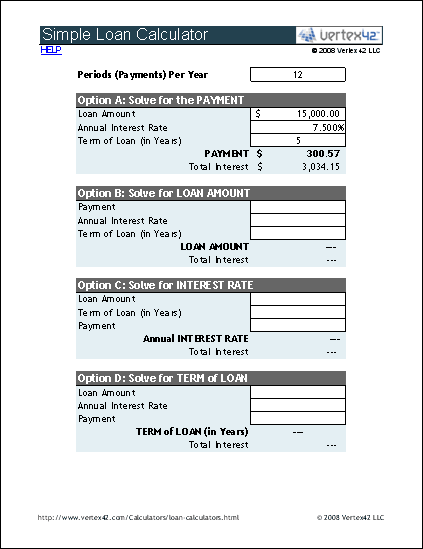

All you need to do is simply enter your loan details and then enter the amount you wish to pre-pay. Do keep in mind that this amount will have to be at least three times the calculated EMI. If the borrower is making the prepayment from his own funds. Home Mortgage Calculator at Bankrate.com - For an online mortgage calculator, this is a pretty good one. To obtain a commercial use license, purchase the Vertex42 Loan Amortization Schedule.

In this step, we will update the total interest and amount. To begin with, first, we need to put the basic information for further calculation. Here, F9 and E10 represent the Principal Remaining of last month and the Principal of the present month. Hence, easily we can get the EMI amount of our loan.

Home Loan - Fees and charges

Also, we made a Prepayment of $5,000 while taking the loan. Prepayment refers to the early repayment of a loan. It is an instalment payment before its due date and is usually a lump sum amount. The minimum sum required to initiate the prepayment of your home loan with Bajaj Finserv is the equivalent of three of your EMIs.

You can figure out how much you need to pay extra to close the loan at the early date. Finally, no matter what the interest rate cycle is, I always believe that LIABILITY is always a LIABILITY. However, I love to live a debt-free life rather than work for someone else. This is with respect to the economy or slowdown in your profession.

Home Loan Calculator with Prepayment

From the image above, we can definitely observe that the monthly Interest is gradually decreasing. As a result, the monthly paid-up Principal is increasing continuously. Because our EMI is constant over the period of 12 months.

It’s a monthly payment that the borrower makes towards repayment of the home loan. The best part about EMI is that you get to repay back the loan in small parts which are easier for most salaried individuals. If something is unaffordable for you as of now, you can purchase it by taking a loan and repaying back in smaller EMIs over a period of time. As mentioned above, a home loan calculator helps you to find the EMI amount of the loan. If you are having any ongoing loan then you have to calculate your total EMI including the current EMI with the running one.

Check out our other mortgage spreadsheets as well, and let us know if you need something that we don't have. Prepayments help you pay off your loan faster and reduce total interest cost. All of these may be good reasons to make additional payments, but make sure you understand what you are doing, first. See below for more information about each of these reasons.

Estimates Property Taxes and Insurance for calculation of the PITI payment. Loan Fees & Charges includes Processing Fees, Administrative Charges etc. along with service taxes, entered either in Rupees or as a percentage of Loan Amount. You need to click on in the yellow banner at the top of the spreadsheet to change variable amounts. When you download Excel spreadsheets from the web they download in PROTECTED VIEW. Loan amount - the amount borrowed, or the value of the home after your down payment.

So that was how you can use the Home Loan EMI calculator India to calculate the EMI on your home loan. You can easily use this loan EMI calculator excel sheet download to calculate your home loan EMIs and create a loan amortization schedule. In case your income increases over the tenure of the loan, you can also speak with your lender to increase your monthly EMI. In both cases, your loan gets repaid faster, and you can save on the overall interest payout. The partial prepayment option is extremely popular among individuals who have borrowed a home loan at a floating rate of interest for non-business purposes.

Because we already have made a prepayment to the bank. So, we’ll subtract this prepayment amount from the total loan amount and will apply EMI on this. Here, we have created a home loan calculator format. Suppose, we’ve taken a Loan Amount of $1,00,000 for 1-year Tenure at 8% of Interest Rate.

However, if you are rejoicing with such offers, then think twice. Many people are looking to maximize the tax benefits of home loans. But if you wish to manage your home loans wisely without compromising other goals, do read this detailed post on managing home loans. If the interest rates are hiked and the lender passes on the hike to borrowers, then your home loan rate will increase. You just need to provide inputs like the loan amount, loan tenure and interest rate.

A house mortgage is a loan provided by a bank, mortgage business, or other financial institution for the acquisition of a primary or second home. A house loan is a secured loan that is acquired for the purpose of buying a property by pledging the asset as security. This is possible because prepaying against the housing loan reduces your interest component. The amount paid towards part pre-payment is deducted from the principal amount outstanding. Using a Calculator to Prepay ARM at mtgprofessor.com - Explains what happens if you make extra payments with an adjustable-rate mortgage. Loan Insurance is the single premium amount, for the Home Loan Protection Plan OR Term Insurance Plan, that gets included in your home loan amount.

Step 5: Evaluate the Total Amount to be Paid of Home Loan Calculator with Prepayment Option in Excel Sheet

If the home loan has been availed of by an individual on a fixed interest rate. Assumes that you will continue to pay the same EMI as per the original schedule after making the part pre-payment. Does not take into account any penalty charges / bounce charges / late payment fees, etc. You are forwarded to payment gateway, select your payment option, you can also easily scan the bar code and make the payment. Down Payment, aka Margin, is the total money you paid to the seller or builder from your own pocket, entered either in Rupees or as a percentage of Home Value.